|

|

|

|

|

|

|

#31 | ||

|

AusMotorsport

Join Date: Dec 2006

Location: Melbourne

Posts: 581

|

I see a trend emerging! I think $1000 in your pocket is better than nothing!

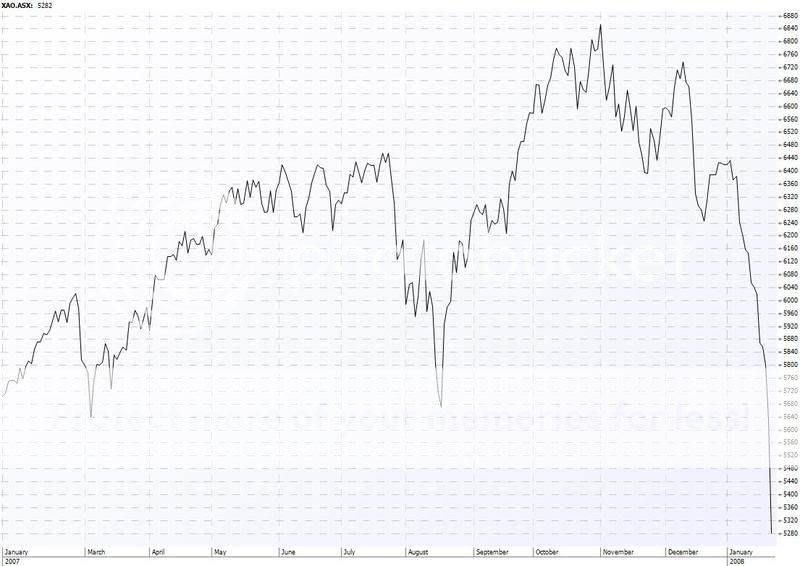

Also interesting to see the All Ords back to about where it was 12 months ago...

|

||

|

|

|

|

|

#32 | |||

|

Long live the GT !

Join Date: Jul 2006

Location: Perth WA

Posts: 1,863

|

Quote:

Gold is the only currency that NEVER loses it's value, it's the backbone of any money/commodity market, and now that the US dollar is effectively worthless, things are gonna change big time... The big fish manipulate the markets to their liking, the numbers are all fixed, eg. the Dow Jones is sitting around 12,000pts right now but consider this, the US dollar has lost 43% of it's value since 2000, that means the 'real' figure is somewhere around 7000pts when you consider hyper-inflation... Food prices have gone up 20% in the past year in the US and they're borrowing $850bn/year from Japan/China just to maintain their economy!!...it's all coming down, that includes the Rothschild/Rockefeller empire aswell.

__________________

2018 Ford Mustang GT - Oxford White | Auto | Herrod Tune | K&N Filter | StreetFighter Oil Separators | H&R Springs | Whiteline Vertical Links | Ceramic Protection | Tint "Whatya think of me car, XR Falcon, 351 Blown Cleveland running Motec injection and runnin' on methanol... goes pretty hard too, got heaps of torque for chucking burnouts, IT'S UNREAL !!" - Poida

|

|||

|

|

|

|

|

#33 | ||

|

Regular Member

Join Date: Sep 2005

Location: Adelaide

Posts: 144

|

please dont start raving on about gold standard v fiat money

|

||

|

|

|

|

|

#34 | ||

|

AusMotorsport

Join Date: Dec 2006

Location: Melbourne

Posts: 581

|

Gold returns certainly don't look too shabby!

|

||

|

|

|

|

|

#35 | ||

|

Now XR8TickfordBoy

Join Date: Aug 2006

Location: Narre Warren, S.E Melbourne

Posts: 463

|

I have no idea about anything stock market related, but, didn't anyone with knoweledge/ experience see this coming? In the fact that the US economy has been doomed since George W took control! Spending billions on wars and other facets that have contributed to an economic decline, even a nuff nuff like me can see the US economy has been doomed and in turn affected our economy/stocks etc. When the majority of our banks/lenders borrow from US based organisations surely its not that big a surprise!

__________________

EF XR8- Respray in Monza Red with Clear Coat, Custom Rear Bar, AU V8, EL GT MAF, Rebuilt and Strengthened Auto with Stage 2 Shift Kit, 2,500RPM Stallie and tranny cooler, Rebuilt Diff with 4.11 Gears, Custom Radiator, King Ultra Lows, Pedders Shocks, NL Concorde Rims. |

||

|

|

|

|

|

#36 | ||

|

Regular Member

Join Date: Sep 2005

Location: Adelaide

Posts: 144

|

US productivity has been stagnant/bordering on decline for years...

(but thats what a deregulated labour market does...) |

||

|

|

|

|

|

#37 | ||

|

FF.Com.Au Hardcore

Join Date: Dec 2004

Posts: 2,504

|

This is a time of high volatility, no doubt about it. For anybody entering the market for the fist time, i would highly recommend finding a highly reputable brokerage firm, assess your investment profile (what sort of investor you are and the risk you're prepared to take).

You should do this, because doing it alone when you're starting out will almost certainly see you fail. You need knowledge and experience in the stock market. Let a broker offer you a selection of companies with healthy balance sheets, growth potential and that have come off their highs because of the correction to date. This will enable you to sleep well at night and put the time in to learn about what makes the market tick, spend time learning the ins and outs of fundamental and technical analysis. When you have achieved this, you can then start to identify stocks off your own bat if you like. Stay completely away from speculative companies with no cashflow but are in 'hot' sectors. There are companies out there that are capitalised at billions with no cashflow to back it up. These are the ones that will fall heavily in corrections and stuggle to regain lost ground the market turns. longer term investments in the market will generally show very good returns. don't get attached to a stock unless you know a lot about it and you are comfortable in holding and can see the growth in the future. the market is not a casino, although it does take money from the inexperienced. Educate yourself would be the most important thing. Has the market hit me? Yes... it's hi everybody. My portfolio was worth around 600K about a month ago? Now around 500K, but because i've adhered to most of what i've explained above, i'm sleeping easily and very confident value will return and increase over the coming year. The market now would be revealing some real good value. there will be lot's of 'pro' money coming in as they realise this. Yes there will be continued volatility in the near term, but there is always opportunity to invest in good companies, even in times of gloom. |

||

|

|

|

|

|

#38 | ||

|

Its yellow, NOT green!

Join Date: Feb 2005

Location: Hunter Valley

Posts: 1,219

|

You are exactly right JEM. Having a background in an investment & stockbroking firm I learnt one main rule - consider the market a medium - long term investment.

I just started playing around with some shares this month for the fun of it more than anything. I hope to make some money, but I can afford to cop a loss. I'm just a bit dissappointed that every stock of mine has had a bad run in the last few days or so. I'm probably better off not to look!

__________________

EL XR8 sedan - low & loud FG XR6 Turbo ute - Auto & Lux pack |

||

|

|

|

|

|

#39 | ||

|

FF.Com.Au Hardcore

Join Date: Jan 2005

Location: coowonga

Posts: 1,654

|

my super will take a pounding but then it did a few years ago as well when some clowns ran those aircraft into a couple of buildings. it should come back again to even higher values. but then again, the people of this country decided on a different government..............so we'll have to wait and see.

|

||

|

|

|

|

|

#40 | ||

|

The Duke

Join Date: Apr 2007

Location: Central Coast NSW

Posts: 1,441

|

Today was the worst day in my trading career ! Just a simply horrific day!

Good luck to the others who trade for a living. It'll be a struggle to recover quickly from this.

__________________

http://www.bseries.com.au/duke |

||

|

|

|

|

|

#41 | ||

|

TBA Customs

Join Date: Jan 2005

Location: giving you what you need

Posts: 3,275

|

Ye but isn't this what most long term investors hold there collective breaths for??

Isn't a crash among the best times to get in particularly on those stocks that previously for whatever reason they hadn't done, blue chips in particular. Or just increase their holdings in any such bluechips they may already have. Sorry for any ignorance on my part but isn't the motto "Buy low", so wouldn't a semi crash environment therefore increase activity and actually stimulate growth back into the market?? I mean blue chips are usually that way for a long time and generally recover well after many a crash, wouldn't that then make this among the best times to buy into blue chips in particular as the drop would make them a little more affordable?? Again sorry for my ignorance, but just a thought really.

__________________

|

||

|

|

|

|

|

#42 | ||

|

AusMotorsport

Join Date: Dec 2006

Location: Melbourne

Posts: 581

|

ASX Stockmarket game starts next month, registration from next week (fills up fast), can subscribe for a reminder:

https://www9.asx.com.au/Smg/CharityInfo?id=1041 |

||

|

|

|

|

|

#43 | |||

|

Nikon

Join Date: Jan 2006

Location: Wollongong

Posts: 1,875

|

Quote:

Go to ComSec Commonwealth Bank heaps of info to get you started |

|||

|

|

|

|

|

#44 | ||

|

Nikon

Join Date: Jan 2006

Location: Wollongong

Posts: 1,875

|

When you look at stockmarket its essential to see for the future term

ie if your under30's look to 20+yrs not end of the week to invest Closer to retirement its wise to look at safer options |

||

|

|

|

|

|

#45 | ||

|

Oh Yeah!

Join Date: Jan 2005

Location: Manhattan, NY

Posts: 1,023

|

Out of IRESS makes the August 07 look small in comparison

Luckly got out of RIO near the top and a few other stocks so managed to reduce my exposure by about 25k however I still had a good amount left over worth well about 30% less haha  Suncorp is looking good sitting at a 7.5% yield fully franked as are a few other stocks. It just a wonder now if they can keep up the dividends this high as to if they are a worthwhile purchase. A few people have been punished in the millions of holding the property trusts check out the yield on rat

__________________

Oh no! Duffman can't breath! Oh, yeah! |

||

|

|

|

|

|

#46 | |||

|

Regular Member

Join Date: Jul 2006

Posts: 364

|

Quote:

|

|||

|

|

|

|

|

#47 | ||

|

GT Driver

Join Date: Jan 2008

Location: Sunshine Coast Queensland

Posts: 156

|

The Stock Market is purely and simply gambling.

Unless you have money you can afford to loose then you should not be investing. I have taken a hell of a battering over the last 10 days with some blue chip shares but it is only a loss if I sell. To play the market successfully you need a large amount of money. It is just like betting on horses or gambling at the casino. The bigger the bet then the better the return (if you win). I have a friend who plays the stock market with 1 million bucks. He buys shares that may only go up half a cent but when they do - he has two million of them. This gives him a nice little earn but it wouldn't mean much if he only had 10,000 of them. This guy is a multi-millionaire now but he went bankrupt in the recession we had to have. You have to spend big to be successful, but you also need to be prepared to loose it all. I wouldn't invest in shares if I had a choice. The government says people who run their own super funds have to diversify in their investments so I can't put all my money into Falcon GT's. I have to buy shares and property as well. I'll just sit on what I have and wait for the market to recover, hopefully. A bit of advice for those contemplating investing. Like all things in life there are success stories with investing. Some people do it well and some do not. It is the do-nots that provide the profit for the successful ones. Unless you spend a lot of time studying the market trends stay the hell away from it unless you are investing blue chip shares which is usually where the big gains aren't. Your only benefit is the dividend. |

||

|

|

|

|

|

#48 | ||

|

.

Join Date: Dec 2004

Location: Bundoora

Posts: 7,199

|

jeez... reading an article on stock markets is for me like doing a university maths exam- bloody hopeless lol

|

||

|

|

|

|

|

#49 | ||

|

The Duke

Join Date: Apr 2007

Location: Central Coast NSW

Posts: 1,441

|

Some very strange advice being given in this thread, that probably includes mine.

I'm a day trader, it's how I make my income, (apart from property investments giving me captial growth), so I have a pretty good view on how things work. I trade shares and various derivatives such as warrants, options and CFD's on a daily basis. The market is not something to be scared of, it's to be respected and used to your advantage and for wealth creation. Isn' this the same as our cars? (without the wealth creation in most cases obviously). For those giving the advice to "stay away" from it... what would you say to someone who says that you should stay away from fast cars because they can kill people.... Easy, drive as carefully as you can, be aware and don't be a lunatic on the roads and you'll stand a much better chance of surviving.... same as the sharemarket.... If you see a horrific crash with dead people on the TV news, it might make you slow down and think a bit more, but you don't run around telling people to never get in a car again... do you? my 2cents... I hope we don't crash again tomorrow or I'm never trading again.... Kidding.

__________________

http://www.bseries.com.au/duke |

||

|

|

|

|

|

#50 | |||

|

Its yellow, NOT green!

Join Date: Feb 2005

Location: Hunter Valley

Posts: 1,219

|

Quote:

: : Mind you, I'm still a tiny bit behind overall for the last few days.  : :

__________________

EL XR8 sedan - low & loud FG XR6 Turbo ute - Auto & Lux pack |

|||

|

|

|

|

|

#51 | ||

|

FF.Com.Au Hardcore

Join Date: Oct 2006

Location: Brisbane, QLD

Posts: 715

|

3 out of my 5 are still making ground, albeit in baby steps. I have however lost ground with my other 2, causing me to lose out in my overall portfolio, by about 9% when my successful 3 are taken into account.

I may look at doing some shopping either tomoro or friday, depending on where things go. Best of luck to everyone.

__________________

05 BF XR6 ZF 6spd - Stock for now Previously: 98 AU Futura 4.0 - Wildcat Extractors, 200cpsi Stainless Cat, Custom 2.5" Mandrel Bent Exhaust, Tickford Snorkel, Fram 'Airhog' Panel Filter - Daily

79 P6 LTD Silver Monarch - Project |

||

|

|

|

|

|

#52 | |||

|

FF.Com.Au Hardcore

Join Date: Dec 2004

Posts: 2,504

|

Quote:

People that lose on the market and then go on a roadshow about how harmful and 'risky' it is are usually people with little experience, acted on less that reliable sources of information, made a mistake etc and simply didn't allow themselves to learn from their mistake. For one to be really successful across any form of investment, i believe, needs a dose of 'losses' at some stage to learn from!! The more you can learn about mistakes will then help to avoid them. the coming months will be a traders dream due to the expected volatility, and the great value created in many great companies due to the correction will prove to be very productive for long term investors also. |

|||

|

|

|

|

|

#53 | |||

|

Regular Member

Join Date: Aug 2006

Location: NoBLe ParK NoRth

Posts: 309

|

My older brother was into the SHORT TERM big gains part of the market he always told me he ended up on par with his starting investment... His advice to me was if you want to win big quick try the casino haha

__________________

Quote:

|

|||

|

|

|

|

|

#54 | |||

|

Nikon

Join Date: Jan 2006

Location: Wollongong

Posts: 1,875

|

Quote:

its times like these that bargains are waiting to be made Market drops shares fall(Blue Chips ones) and people buy in even ppl who have these shares buy more its all about economics |

|||

|

|

|

|

|

#55 | ||

|

Regular Member

Join Date: Mar 2005

Posts: 176

|

My brother worked for Woodside petroleum during the 90's. Over one Xmas, he told us that a new manager was starting who would clean up the company's industrial problems and we should invest in the company.

He was right. Later we were talking about investing in the market and he put it clearly like this: I don't see investing in your own industry as particularly risky. You get to know which company's are well managed and profitable. At the end of the day, your buying part of a company. People who speculate on shares without looking at the fundamentals (profit, contracts, assets, debt etc) are generally lazy or ignorant and open themselves up to losses except in a bull market. I know my industry, the strong performers and those who won't be there in 5 years. If I bought shares, it would obviously be with the strong performers. For companies I know nothing about, no thanks. |

||

|

|

|